Psychology Of Finance: The Art Of Investing

Investing time to learn how to manage your finances can be a great idea. What psychology reveals to us in this regard is that we make notable mistakes in a completely “natural” way. When this happens, the psychology of finance can be our best ally.

In this article we will talk about the relationship between psychology and economics, what the psychology of finance is about, what are the benefits of an assertive use of our finances and some strategies to avoid becoming our own enemies in the economic sphere. We invite you to take this path!

Psychology and economics: foundations of the psychology of finance

Let’s see what these two disciplines are about. Psychology relies on the cognitive, behavioral and affective aspects of the human being. The economy, according to the Accademia della crusca, is that of “Science, which developed from the century onwards. 16 ° in different schools and theories, which can be generally defined as the study of the laws that regulate the production, distribution and consumption of goods, with regard to both the activity of the single economic agent and the more general social order of a state, of a national community “.

But what is the link between the two disciplines? Both study the human being and emphasize the behavior of the latter, oriented towards well-being. Both take into account man’s needs and how he relates to them to get better.

Both, therefore, aim to analyze behaviors and the effects they have on decisions, but they do so from different perspectives. For example, economics focuses more on explaining collective behavior; moreover, the research tools are different: economics, for its part, uses the hypothetical deductive method more, as suggested by the article “New relationships between economics and psychology”, written by Roberta Patalano, researcher at the Parthenope University of Naples.

Psychology – based on the selected approach – can get closer to the health sciences and see far beyond the influence of culture, expense management and the relationship with material goods. However, let’s see some areas that may be of common interest to both sciences:

- Consumer Behavior.

- Advertising and marketing.

- Individual differences.

- Economic socialization.

- Politics.

- Entrepreneurial behavior.

- Financial markets.

- Decision process.

- Identity.

- Meaning of money.

What is the psychology of finance?

The psychology of finance is the discipline that studies and intervenes on the behaviors associated with money. In particular, it analyzes the interaction of financial markets with human nature.

Thus, through the analysis of our behavior, it shows us the psychological barriers that influence the decisions we make regarding our finances. In doing so, it brings us closer to a deeper understanding of our actions; that is, it contributes to greater financial awareness.

Furthermore, it intervenes by showing us the role that the unconscious aspects play when it comes to making decisions associated with money and directs us towards greater assertiveness. Moreover, it not only emphasizes aspects that concern the individual, but also takes into account the influence of the context and the practices associated with money that we have been taught.

How can we not be enemies of ourselves?

James Montier, today one of the best known investors, as well as the author of the book I think therefore I invest. How to be the best ally of your investments , explains how we usually relate to money and what to do to overcome obstacles when we have to make economic decisions, emphasizing the way we behave.

Below we show you some steps to avoid being an enemy of yourself from an economic point of view. Let’s see what it is:

- Manage your emotions. Thanks to this, we will avoid losing control which can lead to the loss of money.

- Don’t trust too much. By not taking this into account in an investment, we will produce lower than desired returns.

- Focus on what looks promising. Despite the losses we have suffered, it is best to move on and focus on something new, which is promising and which leads to choices that we know are a disaster for our investments.

…It’s still:

- Avoid repeating the same dynamics indefinitely, hoping for a better result. Better to ask for advice, re-analyze the situation and do something that involves real change.

- Coping with situations. Bad financial decisions can occur at different times in our life; we must accept them and continue. Making resilience our best weapon can help us move forward and make new decisions, despite fear.

- We allow ourselves to express ourselves. Emotions and thoughts are part of our daily life: let them flow, but be assertive. For example, if you have to make a decision, this is not the time to dwell on an emotion.

On the other hand, we must take into account that we are not perfect beings and that we do not have to be, so it is important to self-correct, be authentic and continue with strategies that bring us advantages.

It is important to know that there are subconscious mechanisms that intervene in our relationship with money and that our personality traits also influence. For this reason, some of us are more spendthrift than others. Do not hesitate to ask for help, to consult an expert in economics, a psychologist or a professional in the psychology of finance who can point you in the right direction to become more assertive.

Benefits of the psychology of finance

Applying the principles of financial psychology or being able to count on an expert financial psychologist to guide us has its great advantages. Let’s see some of them:

- Get higher returns.

- Understanding why we tend to make decisions that harm us.

- Overcoming economic obstacles.

- Expand knowledge about our finances.

- Understanding our conduct issues that lead us to make bad choices.

- Investigate our economic conduct.

Additional benefits …

- Know our relationship with money.

- Discover the psychological barriers that influence decisions associated with money.

- Learn from our economic failures.

- Be more resilient.

- Free yourself from tensions.

- Identify and avoid common investment mistakes.

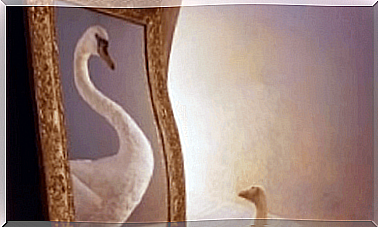

Opening the doors of our life to the psychology of finance means learning something about the wonderful art of investing. It is not easy, but it is a unique path from which we can learn something every day, because every decision will reveal something new about us.

The psychology of finance makes us more assertive towards money : a wonderful way to understand what our relationship with it is and to know in which direction to move for our good.